Mobile Remote Deposit - Deposit Checks from Anywhere!

Mobile Remote Deposit enables you to deposit checks anywhere you have an internet connection. No more scheduling a trip to the bank or waiting on the mail service. Simply snap, upload and confirm your check deposit. Banking has never been easier!

FAQ

Q: What is Peoples State Bank Mobile Remote Deposit?

A: Peoples State Bank Mobile Remote Deposit is an easy way to use our mobile app to deposit checks into your checking, savings and money market account. Other commonly used terms for mobile deposit are remote deposit.

mobile deposit

or remote deposit capture.

Using your mobile device to capture a photo of a check, you can easily make a deposit from anywhere, at anytime.

Q: Is there a fee for using Mobile Remote Deposit?

A: No! While there are no fees for using Mobile Remote Deposit, there are a set of standard parameters to determine the dollar amount and quantity of checks you can deposit. These parameters have been designed to accommodate the average person's remote deposit behaviors.

Q: Who can use Mobile Remote Deposit?

A: All consumer banking customers are eligible to use this service. Customers will need valid online banking credentials, a checking/savings/money market account and our mobile app. Small businesses are also eligible. Customers in our FreshStart program are not eligible.

Q: Will my device work for Mobile Remote Deposit?

A: Mobile Remote Deposit requirements include: a smart phone or other mobile device with high speed internet connection; Apple(R) phones and tablets using iOS versions 13 or 15; Android(TM) phones and tablets using versions Oreo (excluding tablets), Pie and 10.

Q: Where do I sign up?

A: If you are already using our mobile banking app, you are almost there!

If you haven't signed up for mobile banking, you can enroll online at www.psbnewton.com or at any of our locations. On the website, click Online Banking. Below the Login ID field, click enroll now and enter your account information.

Q: How do I set up Mobile Remote Deposit?

Q: How do I set up Mobile Remote Deposit?

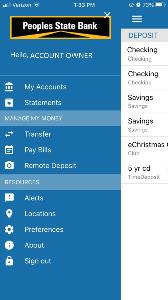

A: Upon logging into your mobile app, tap the 3 menu bars on the top left of the screen.

Under Manage My Money, select Remote Deposit.

Enter your first name, last name and email. Then confirm your email.

Next add all accounts you would like to access for deposits.

Once the bank activates your Mobile Remote Deposit, you will be able to make a deposit. This may take 1-2 business days.

Q: How do I deposit a check?

Q: How do I deposit a check?

A. On the back of the check, write exactly these words: For Mobile Deposit Only PSB and then sign.

Under Remote Deposit, tap the + in the top right corner of the screen.

Take a photo of the front of the check, then the back.

Scroll down to select the account that will receive the deposit and enter the amount. Follow the prompts to complete your deposit.

You will receive a confirmation email that the deposit has been received.

Q: How will I know if the bank received my Mobile Deposit?

A: After you submit the check images, you will receive a screen message on your device that the deposit was received. If there is an issue with the deposit, you will receive a rejection message. If your deposit is rejected for any reason, you will be notified by email. Mobile check deposits are subject to review prior to acceptance. A confirmation email will be sent to you once the check is approved.

Q: How quickly can I use the funds?

A: Deposits that are approved by 3:00 pm CST on a standard business day will generally be available by the next business day. Some deposits require further review and items can be declined. Please review your email for the status of your deposit.

Q: What do I do with the check after using Mobile Remote Deposit?

A; Write Mobile Deposit

or VOID

along with the date of the deposit on the check. Keep checks in an envelope marked mobile deposits

in case verification is needed. You can shred the checks after 30 days. This process prevents finding the check 6 months from now and attempting to deposit/cash it at that time.

Q: What type of checks are acceptable with Mobile Remote Deposit?

A: Business checks, including paychecks and personal checks. We ask that you not deposit Federal Treasury checks such as Social Security or tax refunds. Non-sufficient funds (NSF) checks can't be re-deposited using Mobile Remote Deposit.